UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

Filed by the Registrant x | |||||||||

| |||||||||

Filed by a Party other than the Registranto | |||||||||

Check the appropriate box: | |||||||||

o | Preliminary Proxy Statement | ||||||||

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||||||||

x | Definitive Proxy Statement | ||||||||

| Definitive Additional Materials | ||||||||

| Soliciting Material | under §240.14a-12 | |||||||

VASCO Data Security International, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

VASCO Data Security International, Inc. | |||

(Name of Registrant as Specified In Its Charter) | |||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | |||

Payment of Filing Fee (Check the appropriate box): | |||

x | No fee required. | ||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

(1) | Title of each class of securities to which transaction applies: | ||

(2) | Aggregate number of securities to which transaction applies: | ||

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

(4) | Proposed maximum aggregate value of transaction: | ||

(5) | Total fee paid: | ||

o | Fee paid previously with preliminary materials. | ||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||

(1) | Amount Previously Paid: | |

(2) | Form, Schedule or Registration Statement No.: | ||

(3) | Filing Party: | ||

(4) | Date Filed: | ||

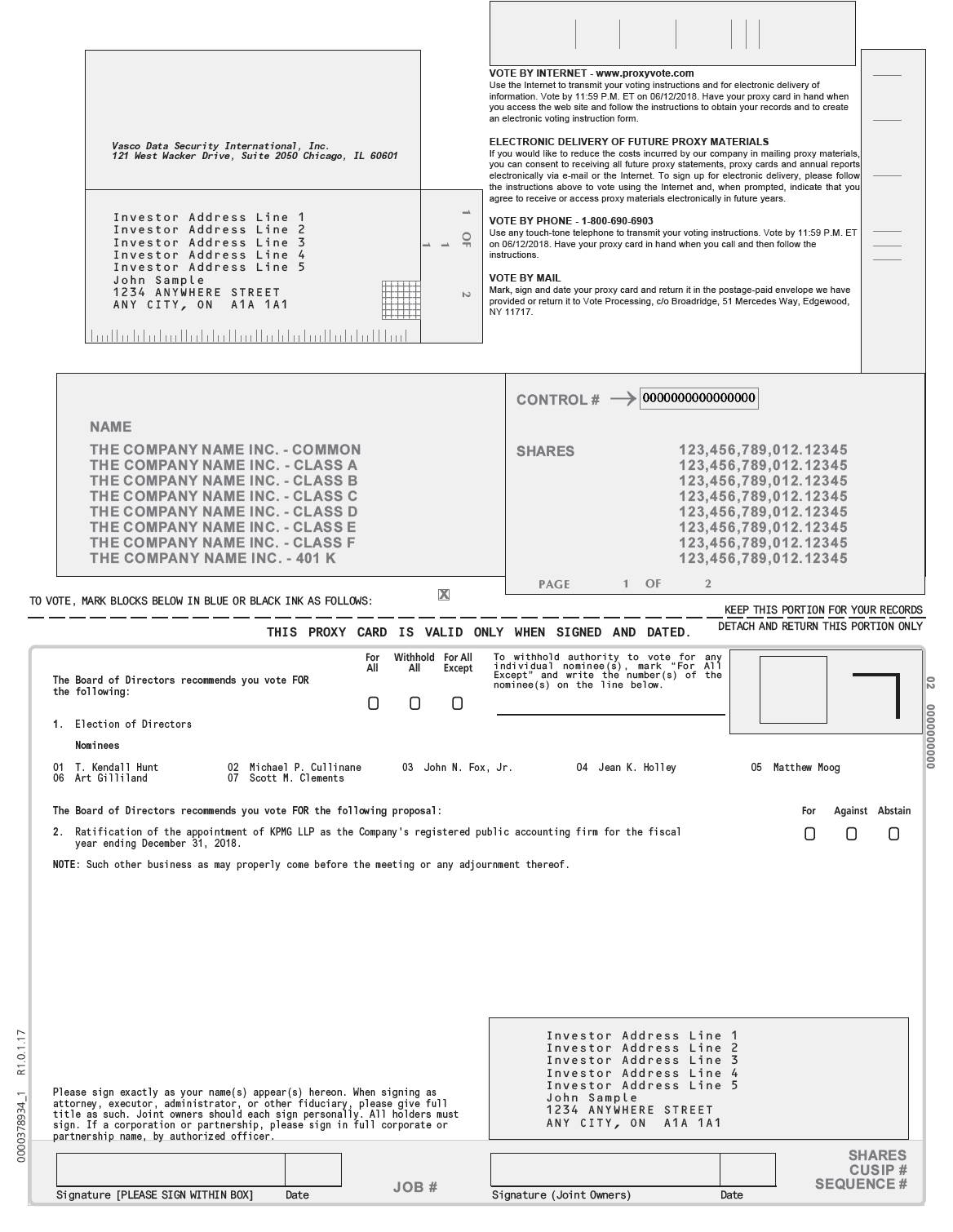

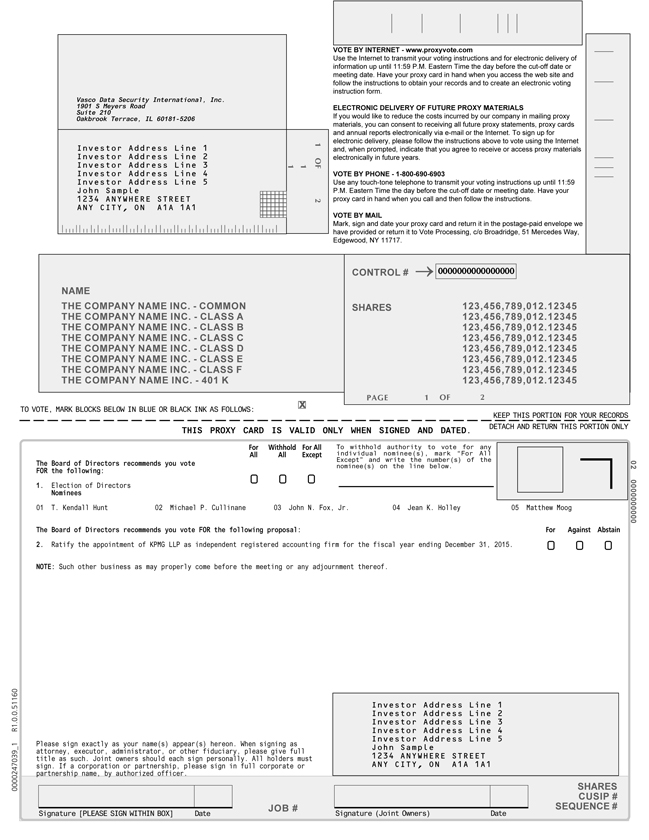

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 17, 201513, 2018

To the Stockholders of

VASCO Data Security International, Inc.:

The Annual Meeting of Stockholders of VASCO Data Security International, Inc., a Delaware corporation (“Company”), will be held on Wednesday, June 17, 2015,13, 2018, commencing at 10:00 a.m., local time, at 1901 South Meyers Road, Oakbrook Terrace, Illinois 60181121 West Wacker Drive, Suite 2400 Chicago, IL 60601 for the following purposes:

1. To elect fiveseven directors to serve on the Board of Directors;

2. To ratify the appointment by the Audit Committee of the Board of Directors of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2015;2018; and

3. To transact such other business as may properly come before the meeting.

The Board of Directors has no knowledge at this time of any other business to be presented or transacted at the meeting.

The Board of Directors recommends that you vote FOR each proposal set forth in this Notice of Annual Meeting of Stockholders and Proxy Statement. Stockholders of record on April 23, 201516, 2018 are entitled to notice of and to vote at the meeting. Further information as to the matters to be considered and acted upon can be found in the accompanying Proxy Statement.

Our Annual Report to Stockholders for 2014 is also enclosed.

By Order of the Board of Directors, |

|

Steven R. Worth |

Secretary |

Oakbrook Terrace,

Chicago, Illinois

April 23, 201527, 2018

You are cordially invited and urged to attend the Annual Meeting in person. To assure your representation at the Annual Meeting, please sign, date and return the enclosed proxy card, whether or not you expect to attend in person. You may revoke your proxy at any time before it is voted at the Annual Meeting.

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 17, 201513, 2018

This Proxy Statement is furnished by the Board of Directors of VASCO Data Security International, Inc. (“Company, “VASCO,” “we,” “us” or “our”), in connection with the solicitation of proxies for use at the Annual Meeting of Stockholders to be held on Wednesday, June 17, 2015 ,13, 2018, commencing at 10:00 a.m., local time, at our principal executive offices located at 1901 South Meyers Road, Oakbrook Terrace, Illinois 60181,121 West Wacker Drive, Suite 2400, Chicago, IL 60601, and at any postponement or adjournment thereof. Directions may be obtained by calling (630) 932-8844.(312) 766-4001. Holders of record of shares of our common stock at the close of business on April 23, 2015,16, 2018, will be entitled to vote on all matters to properly come before the Annual Meeting. Each share of common stock that you own entitles you to one vote.

Important Notice Regarding the Availability of Proxy Materials for the Annual Stockholder

Meeting To Be Held on June 17, 2015:13, 2018:

The Company’s Proxy Statement and Annual Report to Stockholders (including our Annual Report on Form 10-K)10-K are available at: http://www.vasco.com/investorsinvestors.

If you received a notice of internet availability of proxy materials (“E-Proxy Notice”) by mail or electronically, you will not receive a printed copy of the Proxy Statement or Annual StatementReport unless you specifically request one. Instead, the E-Proxy Notice provides instructions on how you may access and review our proxy materials. The E-Proxy Notice also instructs you on how you may submit your proxy via the Internet. If you received the E-Proxy Notice and would still like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials included in the E-Proxy Notice. On or about May 1, 2015,April 30, 2018, we will begin mailing printed copies of our proxy materials to certain of our stockholders and the E-Proxy Notice to all other stockholders.

ANNUAL REPORT

Our Annual Report on Form 10-K to Stockholders for the fiscal year ended December 31, 20142017, has been included in the mailing of this Proxy Statement and weour E-Proxy Notice provides instructions to access our Annual Report through the internet. We recommend that you review it for financial and other information. It is not intended to be a part of the proxy soliciting material.The Annual Report includes, among other information, our Annual Report on Form 10-K for the fiscal year ended December 31, 2014. You can review and download a copy of VASCO’s Annual Report on Form 10-K by accessing our website,www.vasco.com, www.vasco.com/investors, or you can request paper copies, without charge, by writing to VASCO Data Security International, Inc., 1901 South Meyers Road, Suite 210, Oakbrook Terrace, Illinois 60181,121 West Wacker Drive, Ste. 2050, Chicago, IL 60601, Attention: Clifford K. Bown, Secretary.

THE ANNUAL MEETING

Matters to be Considered

The Annual Meeting has been called to:

1. To elect seven directors to serve on the Board of Directors (Proposal 1);

2. To ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2018 (Proposal 2); and

3. To transact such other business as may properly come before the meeting.

Voting at the Annual Meeting

A majority of the votes entitled to be cast on matters to be considered at the Annual Meeting will constitute a quorum for the transaction of business. If a share is represented for any purpose at the meeting, it is deemed to be present for all other matters. Holders of record of outstanding shares of common stock at the close of business on April 23, 201516, 2018, are entitled to notice of and to vote at the Annual Meeting. As of April 23, 2015,16, 2018, there were 39,775,36440,197,960 shares of common stock outstanding and entitled to vote. Each share of common stock is entitled to cast one vote on any matter submitted to the stockholders for approval.

Assuming the presence of a quorum, the affirmative vote of a plurality of the votes cast and entitled to vote will be required for Proposal 1,and the affirmative vote of a majority of the votes cast and entitled to vote thereon will be required for Proposal 2. There is no cumulative voting in the election of directors.

Stockholders may vote in favor of or withhold authority to vote for the nominees for election as directors listed under Proposal 1. Stockholders may vote for or against, or abstain from voting on, Proposal 2. Abstentions and withheld votes will be counted by the election inspector in determining whether a quorum is present.

With respect to Proposal 1, each nominee must receive a plurality of the votes cast and entitled to vote, and any director nominee who receives a greater number of withhold votes than affirmative votes in an uncontested election is expected to tender to the Board his or her resignation promptly following the certification of election results pursuant to the Company’s majority vote policy, more fully described in Proposal No. 1, below. Under the majority vote policy, abstentions and broker non-votes will not have an impact on the election of directors.

With respect to Proposal 2, whichit requires the approval of a majority of the votes cast and entitled to vote thereon, abstentions will have nothe same effect on the outcome of the vote onas voting against such proposal.

Broker non-votes will also be counted by the election inspector in determining whether a quorum is present. Broker non-votes are proxies received from brokers when the broker has neither received voting instructions from the beneficial owner nor has discretionary power to vote on a particular proposal. Broker non-votes,

because they are not considered “votes cast,” are not counted in the vote totals and will have no effect on the election of directors or the approval of any proposal considered at the Annual Meeting. Brokers are subject to the rules of the New York Stock Exchange (“NYSE”), and the NYSE rules provide that brokers only possess discretionary power to vote on matters that are considered routine,,such as the ratification of the independent registered public accounting firm described in Proposal 2. In contrast, brokers do not have discretionary authority to vote shares held in street name on non-routine matters. Under the NYSE rules, the election of directors is not considered a routine matter. As a result, with respect to Proposal 1, shares held in street name will not be voted unless the broker is given voting instructions by the beneficial owner. With respect to Proposal 2, brokers have the discretionary authority to vote shares held in street name even if they do not receive voting instructions from the beneficial owner.

2

If a properly executed, unrevoked proxy does not specifically direct the voting of the shares covered by such proxy, the proxy will be voted:

1. FOR the election of all nominees for election as director as listed herein;

2.FOR the ratification of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2018, and

3. In accordance with the judgment of the persons named in the proxy as to such other matters as may properly come before the Annual Meeting.

Any stockholder executing a proxy has the power to revoke it at any time before it has been voted by delivering written notice to the Secretary of the Company, by executing a later-dated proxy or by voting in person at the Annual Meeting. Any written notice of revocation or subsequent proxy should be delivered prior to June 17, 201513, 2018 to:

VASCO Data Security International, Inc.

1901 South Meyers Road,121 West Wacker Drive, Suite 2102050

Oakbrook Terrace,Chicago, Illinois 6018160601

Attention: Secretary

or

Alternatively, hand delivered to the Secretary before the closing of the polls at the Annual Meeting.

PROPOSAL 1

3

PROPOSAL 1

ELECTION OF DIRECTORS

Stockholders are being asked to elect fiveseven directors. All of the director nominees will be elected at the Annual Meeting. Each director will serve until the annual meeting in 2016,2019, until a qualified successor director has been elected, or until he or she resigns, dies or is removed.

The Board of Directors, upon the recommendation of the Corporate Governance and Nominating Committee, has nominated the following individuals for election as directors at the Annual Meeting: Scott M. Clements, Michael P. Cullinane, John N. Fox, Jr., Art Gilliland, Jean K. Holley, T. Kendall Hunt and Matthew Moog, all of whom are current directors and have agreed to serve if elected.

While the Board of Directors does not contemplate that any nominee for election as a director will not be able to serve, if unforeseen circumstances (for example, death or disability) make it necessary for the Board of Directors to substitute another person for any of the nominees, the persons listed in the enclosed proxy will vote your proxy, if properly executed and returned and unrevoked, for such other person or persons, or the Board may, in its discretion, reduce the number of directors to be elected. The affirmative vote of a plurality of the votes cast and entitled to vote at the Annual Meeting is required for the election of directors but under the majority voting policy in the VASCO Corporate Governance Guidelines, any director nominee who receives a greater number of withhold votes than affirmative votes in an uncontested election is expected to tender to the Board his or her resignation promptly following the certification of election results. Under the plurality voting standard and our majority voting policy, abstentions and broker non-votes will not have an impact on the election of directors.

The Board of Directors recommends that the stockholders vote “FOR” each of the nominees listed herein.

PROPOSAL 2

RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board of Directors has appointed KPMG LLP as the independent registered public accounting firm for the fiscal year ending December 31, 2015.2018.

If our stockholders fail to ratify the appointment, the Audit Committee will reconsider this appointment. Even if the appointment is ratified, the Audit Committee, in its discretion, may direct the appointment of a different independent registered public accounting firm at any time during the year if the Audit Committee determines that such a change would be in the best interests of the Company and its stockholders.

KPMG LLP served as independent registered public accounting firm for the fiscal year ended December 31, 20142017, and has acted as independent registered public accounting firm for the Company, and its predecessor, VASCO Corp., since 1994.1996. Representatives of KPMG LLP are expected to be present at the Annual Meeting, and such representatives will have an opportunity to make a statement, if they desire to do so, and are expected to be available to respond to appropriate questions.

The Board of Directors recommends that the stockholders vote “FOR” the appointment of KPMG LLP as the independent registered public accounting firm for the fiscal year ending December 31, 2015.2018.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS, DIRECTORS AND MANAGEMENT

Except as otherwise indicated below, the table below sets forth certain information with respect to the beneficial ownership of our common stock as of March 31, 2015,2018, for (i) each of our directors, (ii) each of our named executive officers, (iii) all directors and executive officers as a group, and (iv) each person or entity known by VASCO to beneficially own more than 5% of the outstanding shares of common stock. The persons named in the table have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them unless otherwise indicated. For purposes of the table, a person or group of persons is deemed to have beneficial ownership of any shares as of a given date that such person has the right to acquire within 60 days after such date.

| Name of beneficial owner | Amount and nature of beneficial ownership(1) | Percent of class |

| Amount and nature of beneficial |

| Percent of class |

| ||||||

Executive Officers and Directors |

|

|

|

|

| ||||||||

T. Kendall Hunt | 9,096,965 | (2) | 22.87 | % |

| 8,237,261 | (2) | 20.44 | % | ||||

Jan Valcke | 620,471 | 1.56 | % | ||||||||||

Clifford K. Bown | 339,614 | * | |||||||||||

Scott Clements |

| 245,120 |

| * |

| ||||||||

Mark S. Hoyt |

| 121,573 |

| * |

| ||||||||

Michael P. Cullinane | 161,434 | * |

| 184,954 |

| * |

| ||||||

John N. Fox | 94,727 | (3) | * | ||||||||||

John N. Fox, Jr. |

| 104,454 |

| * |

| ||||||||

Jean Holley | 85,654 | (4) | * |

| 108,669 |

| * |

| |||||

Matthew Moog | 24,740 | * |

| 48,260 |

| * |

| ||||||

All Executive Officers and Directors as a group (7 persons) | 10,423,605 | 26.21 | % | ||||||||||

Arthur W. Gilliland |

| 6,994 |

| * |

| ||||||||

All Executive Officers and Directors as a group (8 persons) |

| 9,057,285 |

| 22.48 | % | ||||||||

5% Stockholders |

|

|

|

|

| ||||||||

BlackRock, Inc. | 2,889,285 | (5) | 7.26 | % |

| 3,896,183 | (3) | 9.67 | % | ||||

* | Ownership is less than 1%. |

(1) | The number of shares beneficially owned by each director and executive officer is determined under rules promulgated by the SEC, and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any shares as to which the individual has sole or shared voting power or investment power and |

(2) | Includes 1,011,300 shares held in the Barbara J. Hunt Marital Trust. The amount also includes 200,000 shares held by T. Kendall Hunt’s spouse |

(3) | Based solely on a Schedule 13G/A filed on January |

The following table sets forth shares of our common stock that were authorized to be issued as of December 31, 20142017, under the Company’s 1997 Stock Compensation Plan, as amended and restated in 1999 (the “1997 Stock Compensation Plan”) and the 2009 Equity Plan. Upon our stockholders’ reapproval of the 2009 Equity Plan, our 1997 Stock Compensation Plan was suspended and no additional awards will be issued under the 1997 Stock Compensation Plan. However, all outstanding awards under the 1997 Stock Compensation Plan were unaffected by our stockholders’ reapproval of the 2009 EquityIncentive Plan.

Equity Compensation Plan Information

| Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted- average exercise price of outstanding options, warrants and rights | Number of reflected in column (a)) (1) |

| Number of |

| Weighted |

| Number of securities reflected |

| ||||||||||

| (a) | (b) | (c) |

| (a) |

| (b) |

| (c) |

| |||||||||||

Equity compensation plans approved by security holders | 0 | $ | 0.00 | 6,597,474 |

| 0 |

| $ | 0.00 |

| 6,113,030 |

| ||||||||

Equity compensation plans not approved by security holders | not applicable | not applicable | not applicable |

| not applicable |

| not applicable |

| not applicable |

| ||||||||||

Total | 0 | $ | 0.00 | 6,597,474 |

| 0 |

| $ | 0.00 |

| 6,113,030 |

| ||||||||

(1) | Subject to adjustment for stock dividends, stock splits and other similar events, a maximum of |

DIRECTORS AND EXECUTIVE OFFICERS

The names of and certain information regarding our current directors who are nominated for the election and our executive officers appear below.

T. KENDALL “KEN” HUNT—Mr. Hunt is our founder, and Chairman of the Board and Chief Executive Officer.Board. Mr. Hunt has served as Chairman of the Board since the Company’s incorporation in 1997, and currently serves a one-year term. He was our Chief Executive Officer from 1997 through 1999 and returned as CEO in November 2002.2002 through 2017. He served as a member of the Board of Directors of Global Med Technologies, Inc. from March 2006 until April 2010 and RedRoller Holdings, Inc. from December 2007 until December 2008. He holds an MBA from Pepperdine University, Malibu, California, and a B.B.A. from the University of Miami, Florida. Mr. Hunt is 7174 years old.

Mr. Hunt has extensive experience in international business, internet and network security, and the acquisition and development of businesses in the United States and Europe. His day-to-day leadership, as Chief Executive Officer of VASCO, providesprovided him with intimate knowledge of our operations and corporate strategy.

MICHAEL P. CULLINANE���—Mr. Cullinane has been a director since April 1998 and currently serves a one-year term. He is the Chairman of our Audit Committee and a member of our Compensation Committee and our Corporate Governance and Nominating Committee. From May 2008 through September 2013, Mr. Cullinane served as Executive Vice President and CFOChief Financial Officer of SilkRoad, Inc., a cloud-based software services company in the human capital management space. Mr. Cullinane served as the Executive Vice President and Chief Financial Officer of Lakeview Technology Inc. from January 2005 to July 2007. Mr. Cullinane served as the Executive Vice President and Chief Financial Officer and a director of Divine, Inc. from July 1999 to May 2003. He served as Executive Vice President, Chief Financial Officer and a director of PLATINUM Technology International, Inc. from 1988 to June 1999. Mr. Cullinane received a B.B.A.BBA from the University of Notre Dame, South Bend,��Indiana. Mr. Cullinane is 6568 years old.

Mr. Cullinane has an extensive finance, accounting and technology background, having served as chief financial officer of four technology companies, two of which were publicly traded. He provides the Board with unique insights into the Company’s growth strategies, and global financial and accounting matters.matters, and operations.

JOHN N. FOX, JR.—Mr. Fox has been a director since April 2005 and currently serves a one-year term. He is Chairman of our Compensation Committee and is a member of our Audit Committee and our Corporate Governance and Nominating Committee. From 1998 to 2003, Mr. Fox served as a Vice Chairman of Deloitte & Touche and the Global Director, Strategic Clients for Deloitte Consulting. He held various other positions with Deloitte Consulting from 1968 to 2003, and served on the board of Deloitte Touche Tohmatsu from 1998 to 2003. Since 2007, Mr. Fox has been a director of Cognizant Technology Solutions Corporation andwhere he serves onas the Chairman of the Compensation Committee and is a member of the Nominating and Governance Committee. Mr. Fox received his B.A.BA degree from Wabash College and his MBA from the University of Michigan. Mr. Fox is 7275 years old.

Mr. Fox has extensive global business experience having served as vice chairman and global director of an internationally prominent consulting firm. He has over 34 years of experience advising clients on large scale, complex transactions, including strategic initiatives, new business models, reengineered business processes, merger integration and organizational change. He provides the Board with the perspective of an executive with direct project management, staffing, compensation and organizational process experience.

ARTHUR GILLILAND - Mr. Arthur Gilliland has been a director since December 2017 and currently serves until the June 2018 shareholder meeting. He is a member of the Audit Committee, Compensation Committee and Corporate Governance and Nominating Committee. Mr. Gilliland is a senior enterprise software executive. His experience leading both mature and high-growth emerging technology companies complements VASCO’s increased focus on its rapidly growing software business. Art is currently CEO of Skyport Systems where he led all aspects of the company from pre-product start-up to first customer shipment, and to significant growth within its Fortune 500 target customer base. Mr. Gilliland earned a Bachelor’s degree in Economics from Carleton College and a Master’s of Business Administration from the Harvard Business School. Recognized as an information security expert, he also holds several key patents in security and is a Certified Information Systems Security Professional (CISSP). Mr. Gilliland is 47 years old.

Prior to Skyport Systems, Art was Hewlett Packard’s SVP and General Manager, Enterprise Security Products. In this role, he was responsible for all aspects of the company’s security software business that drove its global P&L, including sales, marketing, product development, operations and support. Prior to HP, Art was SVP of Symantec Corporation’s Information Security Group where he led engineering, product development, industry relations and operations for the company’s Data Loss Prevention, Encryption, Compliance, Trust Services, User Authentication, Security Incident Management, Security Intelligence and Managed Security Services solutions. Mr. Gilliland brings to the Board the perspective of a technology executive, including as CEO, with experience across all functional areas, and in particular he brings industry experience relevant to the Company including security, SaaS, identity and access management, and data management.

JEAN K. HOLLEY—Ms. Holley has been a director since August 2006 and currently serves a one-year term. She is Chair of the Corporate Governance and Nominating Committee and a member of the Audit Committee and Compensation Committee. Ms. Holley has been servingserved as Group Senior Vice President and Chief Information Officer for Brambles Limited, the world’s leading provider of palletglobal leader in supply chain and container poolinglogistic solutions, and provider of information management solutions, sincefrom September 2011.2011 until her retirement in July 2017. From April 2004 until August 2011,

7

Ms. Holley served as the Executive Vice President and Chief Information Officer for Tellabs, Inc., a company that designs, develops, deploys and supports telecommunications networking products around the world. Ms. Holley previously served as the Vice President and Chief Information Officer for USG Corporation from 1999 to 2003. Prior to that, she served as Senior IT Director for Waste Management, Inc. Since August 2017, Ms. Holley has been a director of Herc Holdings Inc., and serves on the Audit and Financing Committees. Ms. Holley holds a B.S. in Computer Science/Electrical Engineering from Missouri University Science & Technology, and a M.S. in Computer Science/Engineering from Illinois Institute of Technology in Chicago. Ms. Holley is 5659 years old.

Ms. Holley has an extensive background in information technology (IT) and engineering, global operations and manufacturing, corporate strategy and product development, having served as the chief information officer of two public companies. She brings to the Board the perspective of a technology executive with many years of experience in operations, communications strategy planning, product development, IT capabilities and data security.

MATTHEW MOOG—Mr. Moog has been a director since December 2012 and currently serves a one-year term. He is a member of the Audit Committee, Compensation Committee and Corporate Governance and Nominating Committee. Mr. Moog is CEO of Power Reviews, Inc., a leading consumer ratings and reviews service. In this role, Mr. Moog is responsible for leading the company to create innovative products and services that help consumers make smart decisions and help businesses gain valuable feedback. In addition, Mr. Moog is Founder of Built In, a network of regional online communities that connect, educate, and promote digital entrepreneurs and innovators. Mr. Moog is also the founder of the FireStarter Fund, an early stage investment fund focused on digital technology companies, and chaired the project to launch 1871, a 50,000 square foot co-working center for technology startups in Chicago. Mr. Moog holds a BA in Political Science from the George Washington University. Mr. Moog is 4548 years old.

Previously, Mr. Moog served as President &and CEO of publicly-tradedpublicly traded Q Interactive, EVP Sales and Marketing at CoolSavings, Inc. the predecessor to Q Interactive and Business Development Manager at Microsoft. Mr. Moog holdsbrings to the Board the perspective of a BAtechnology executive with many years of experience in Political Science from George Washington University.sales, business development, product development, cloud computing, capital allocation and executive management.

Executive Officers

JAN VALCKESCOTT M. CLEMENTS——Mr. ValckeClements is our President and Chief OperatingExecutive Officer and has held this position since 2002.July 2017. He served as President and Chief Operating Officer from November 2016 through July 2017. Mr. Valcke has been an officer ofClements joined the Company since 1996. From 1992in 2015 as Executive Vice President and Chief Strategy Officer. Prior to 1996, he was Vice-President of Sales and Marketing of Digipass NV/SA, a member of the Digiline group. He co-founded Digiline in 1988joining VASCO, Mr. Clements spent 11 years at Tyco International and was most recently Corporate Senior Vice President, Business Development focused on technology acquisitions in 2015. Mr. Clements served as President of Tyco Retail Solutions from 2007 to 2014 and as Tyco’s Chief Technology Officer from 2012 to 2014. Before joining Tyco, Mr. Clements spent a memberdecade at Honeywell International in domestic and international financial and operational leadership roles. Mr. Clements received a BS in Chemical Engineering and Advanced Process Control from The Ohio State University and an MBA in Finance and Corporate Strategy from the University of Michigan in Ann Arbor. Mr. Clements is 55 years old.

MARK S. HOYT—In November 2015, the Board of Directors of Digiline.appointed Mr. Valcke received a degree in Science from St. Amands College in Kortrijk, Belgium. Mr. Valcke is 60 years old.

CLIFFORD K. BOWN—Mr. Bown is our Executive Vice President,Hoyt to the positions of Chief Financial Officer and Secretary and has served as ourTreasurer. In March 2018, the Board also appointed Mr. Hoyt an Executive Vice President. Mr. Hoyt joined the Company in October 2015. Prior to joining the Company, Mr. Hoyt was the Chief Financial Officer since 2002.of Groupon, Inc. operations in Europe, Middle East and Africa, based in Switzerland from 2012 to 2015, and from 2010 to 2012, he was Vice President of International Financial Operations of Groupon, Inc. based in Chicago. Mr. Bown startedHoyt is a CPA and began his career with KPMG LLP where he directed the audits for several publicly held companies, including a global leader in integratedat PricewaterhouseCoopers, followed by international positions at Motorola, Inc. and embedded communications solutions. From 1991 to 1993, he was CFO for publicly held XL/DATACOMP, a $300 million provider of midrange computer systems and support services in the U.S. and U.K.CareerBuilder. Mr. Bown also held CFO positions in two other companies focused on insurance and healthcare from 1995 through 2001. Mr. Bown received a B.S. in Accountancy from the University of Illinois, Urbana, Illinois, his M.B.A.Hoyt holds an MBA from the University of Chicago Booth School of Business and he has a CPA certificate.BS in Accountancy from Miami University. Mr. BownHoyt is 6450 years old.

Meetings of the Board of Directors

The Board of Directors met eleven8 times during 2014.2017. Each incumbent director attended at least 90%96% of the meetings of the Board and the meetings held by all committees on which he or she served in 2014,2017, in the aggregate. As part of their duties, the directors are expected to attend the annual meetings of stockholders. Each of the directors attended last year’s annual meeting.

8

The Board of Directors presently has three standing committees, the Corporate Governance and Nominating Committee, the Audit Committee and the Compensation Committee, each of which is described more fully below.

Board Independence

Our Board of Directors conducts an annual review as to whether each of our directors meets the applicable standards of the NASDAQ Stock Market Rules. Our Board of Directors has determined that each of the current directors and director nominees, other than T. Kendall Hunt and Scott M. Clements, has no material relationship with VASCO other than as a director and is independent within the listing standards of NASDAQ. In making its independence determinations, the Board of Directors has broadly considered all relevant facts and circumstances and has concluded that there are no transactions or relationships that would impair the independence of any of the directors or director nominees, other than T. Kendall Hunt.Hunt and Scott M. Clements.

Board Leadership Structure

The current leadership structure of the Company provides for the combinationseparation of the roles of the Chief Executive Officer and the Chairman of the Board of Directors. T. Kendall Hunt, the founder of VASCO, serves as both our Chairman of the Board and Scott M. Clements, also a director, serves as our President and Chief Executive Officer. At this time, the Board believes that in light of the Company’s size, the nature of our business, and the need for both a strong business and technical knowledge base in its decision making, the combinationseparation of these roles serves the best interests of VASCO and our stockholders. As the founder of VASCO, Mr. Hunt is uniquely qualified to leadguide our Board and to ensure that critical business issues are brought before the Board. WeMr. Hunt also believe thatretained the combinationChairman role following his resignation as CEO in 2017 which allowed Mr. Clements to transition to CEO without the additional Chairman responsibilities.

Lead Independent Director

Although the current Board leadership structure includes the separation of the roles of CEO and Chairman, our Chairman, Mr. Hunt, is not considered “independent” under the Chief listings standards of NASDAQ. In 2017, the Board adopted a lead independent director policy and designated a lead independent director, Mr. John Fox. Such policy may be found in the Investor Relations section of our website www.vasco.com. The duties of the lead independent director include:

Executive Officer and the ChairmanSessions

· Preside at all meetings of the Board of Directors at which the Chairman is appropriate in lightnot present, including executive sessions of the independent oversightDirectors. Provide a report to the CEO on all relevant matters arising from those sessions, and invites the CEO to join those sessions for further discussion as appropriate.

Call Meetings of Independent Directors

· Has the authority to call meetings of the Board. Althoughindependent Directors. Provide a report to the CEO on all relevant matters arising from those sessions, and invites the CEO to join those sessions for further discussion as appropriate.

Board Information, Agendas and Schedules

· Provide input on the quality, quantity, appropriateness and timeliness of information supplied by management to the Board has not designated a lead independent director,with the Company has a long historyobjective of strongobtaining information sufficient for the Board to make informed decisions.

· Collaborate with the CEO, Chairman and management on setting the agenda for each Board meeting.

· Provide input on the frequency of Board meetings and meeting schedules, assuring there is sufficient time for discussion of all agenda items.

Our independent directors with four of the five current members of the Board being independent.regularly meet alone in executive session. In addition, the Audit, Compensation and Corporate Governance and Nominating Committees are comprised solely of independent directors. The Board regularly reviews the Company’s leadership structure and reserves the right to alter the structure as it deems appropriate.

The Board’s Role in Risk Oversight

The Board of Directors is primarily responsible for overseeing the assessment and management of the Company’s risk exposure and does so directly and through each of its committees. The Board of Directors and each of its committees regularly discuss with management the Company’s major risk exposures, their likelihood, the potential financial impact such risks may have on the Company, and the steps the Company must taketakes to manage any such risks. The Audit Committee oversees the Company’s risks and exposures regarding financial reporting and legal compliance. The Compensation Committee oversees risk management relating to our overall incentive compensation programs, including those for senior management. The Corporate Governance and Nominating Committee oversees risks related to succession planning and compliance with our Corporate Governance Guidelines and Code of Conduct and Ethics. As necessary or appropriate, the Board and its committees may also retain outside legal, financial or other advisors. The Board reviews the Company’s overall risk management program is reviewed at least annually by the Board.annually. Throughout the year, management updates the Board and relevant committees about factors that affect areas of potential significant risk. We believe that this is an effective approach for addressing the risks faced by VASCO and that our Board’s leadership structure, which combines the roles of the Chief Executive Officer and the Chairman of the Board of Directors,with a Lead Independent Director, also supports this approach by providing a greater link between the Boardadditional insights and management.experience with risk oversight.

Communications with Directors

Stockholders may send communications to the Board of Directors at the Company’s address, 1901 South Meyers Road,121 West Wacker Drive, Suite 210, Oakbrook Terrace, Illinois 60181.2050, Chicago, IL 60601. Any such communication addressed to a specific Board member and designated as “Confidential” will be delivered unopened to the specific Board member. If a

9

communication is addressed to the Board as a whole and designated as “Confidential,” the communication will be delivered to the Chairman of the Corporate Governance and Nominating Committee. Any communication not designated as “Confidential” will be reviewed by management and brought to the attention of the Board at its next regularly scheduled meeting.

Corporate Governance and Nominating Committee

The Board of Directors constituted and established the Corporate Governance and Nominating Committee with authority, responsibility, and specific duties as described in the Corporate Governance and Nominating Committee Charter. A copy of the charter is available on our website,www.vasco.com. www.vasco.com/investors in the corporate governance section of our investor relations webpage. The primary function of this committee is to assist the Board in:

·Determining the appropriate structure of the Board, including committees;

·Evaluating the performance of the Board and management;

·Identifying and recommending to the Board individuals to be nominated as a director, including the consideration of director candidates recommended by stockholders;

·Providing oversight of management succession plans;

·Providing oversight of the Corporate Governance Guidelines; and

·Providing oversight of the Code of Conduct and Ethics.

The Corporate Governance and Nominating Committee will consider director candidates who have relevant business experience, are accomplished in their respective fields, and who possess the skills and expertise to make a significant contribution to the Board of Directors, the Company and its stockholders. Director nominees should have high-leadership business experience, knowledge about issues affecting the Company and the ability and willingness to apply sound and independent business judgment. VASCO does not have a formal policy with respect to diversity. However, the Board believes that it is essential that VASCO’s Board members represent diverse viewpoints, with a broad array of business experiences, professions, skills and backgrounds that, when considered as a group, provide a sufficient mix of perspectives to allow the Board to best fulfill its responsibilities to the long-term interests of our stockholders.

The Corporate Governance and Nominating Committee will consider nominees for election to the Board of Directors that are recommended by stockholders, provided that a complete description of the nominees’ qualifications, experience and background, together with a statement signed by each nominee in which he or she consents to act as such, accompany the recommendations. Such recommendations should be submitted in writing to the attention of the Corporate Governance and Nominating Committee, c/o VASCO Data Security International, Inc., 1901 South Meyers Road, Suite 210, Oakbrook Terrace, Illinois 60181121 W. Wacker Drive., Suite. 2050, Chicago, IL 60601 not less than 60 nor more than 90 days prior to the date of the Annual Meeting of Stockholders at which the nomination is to be made and should not include self-nominations. The committee applies the same criteria described above to nominees recommended by stockholders.

The Corporate Governance and Nominating Committee is comprised of three or more directors, each of whom must be an independent director, as defined by the NASDAQ Stock Market Rules. The members of the committee are elected by the Board at its annual organizational meeting and serve at the pleasure of the Board until their successors are duly elected and qualified. The members of the Corporate Governance and Nominating Committee are Jean K. Holley (Chair), Michael P. Cullinane, Art Gilliland, John N. Fox, Jr., and Matthew Moog. The Corporate Governance and Nominating Committee met threefour times during 2014.2017.

Compensation Committee

The Compensation Committee of VASCO’s Board of Directors is composed of three or more independent directors as determined in accordance with applicable rules of the Nasdaq Stock Market and the SEC and applicable rules under the Code. The Compensation Committee operates under a written charter adopted by the

10

Board of Directors. A copy of the charter is available on our website,www.vasco.com. www.vasco.com/investors in the corporate governance section of our investor relations webpage. The Compensation Committee acts on behalf of our Board of Directors to establish the compensation of VASCO’s named executive officers and makes recommendations to the Board regarding compensation of our non-employee directors. The Compensation Committee oversees risk management relating to our overall incentive compensation programs, including those for senior management. The Compensation Committee administers the Company’s 1997 Stock Compensation Plan, the Company’s 2009 Equity Incentive Plan and the VASCO Data Security International, Inc. Executive Incentive Compensation Plan (the “Executive Incentive Compensation Plan”). The members of the Compensation Committee are John N. Fox, Jr. (Chairman), Michael P. Cullinane, Art Gilliland, Jean K. Holley, and Matthew Moog. The Compensation Committee met sevensix times during 2014.2017.

Audit Committee

The Audit Committee of the Board of Directors, as established in accordance with Section 3(a)(58)(A) of the Exchange Act, is composed of three or more independent directors, as required by the NASDAQ Stock Market Rules, who also meet the additional independence standards required for audit committee members. The Audit Committee operates under a written charter adopted by the Board of Directors and is responsible for overseeing the financial reporting process on behalf of the Board. A copy of the charter is available on our website,www.vasco.com. www.vasco.com/investors in the corporate governance section of our investor relations webpage. The members of the Audit Committee are Michael P. Cullinane (Chairman), John N. Fox, Jr., Art Gilliland, Jean K. Holley, and Matthew Moog. The Board of Directors has determined that Messrs. Cullinane and Moog qualify as audit committee financial experts and has designated them as such. Each year, the Audit Committee recommends the selection of the independent registered public accounting firm to the Board of Directors. We are not required under our charter or Bylaws to submit the selection of the independent registered public accounting firm to a vote of the stockholders. The Audit Committee met ten10 times during 2014.

REPORT OF THE AUDIT COMMITTEE

Management is responsible for the Company’s financial statements and the financial reporting process, including internal controls. The independent registered public accounting firm is responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with auditing standards generally accepted in the United States and for issuing a report thereon. The Audit Committee’s responsibility is to monitor and oversee these processes.

In this context, the Audit Committee held discussions with management and KPMG LLP. Management represented to the Audit Committee that the Company’s consolidated financial statements were prepared in accordance with generally accepted accounting principles, and the Audit Committee reviewed and discussed the consolidated financial statements with management and KPMG LLP. The Audit Committee discussed with KPMG LLP the matters required to be discussed by Auditing Standard No. 16 (Communication1301, as amended, (Communications with Audit Committees) as adopted by the Public Company Accounting Oversight Board in Rule 3200T.Board. These matters included a discussion of KPMG LLP’s judgments about the quality (not just the acceptability) of the Company’s accounting principles as applied to financial reporting.

The Audit Committee also received the written disclosures and the letter from KPMG LLP required by applicable requirements of the Public Company Accounting Oversight Board regarding KPMG LLP’s communication with the Audit Committee concerning independence, and has discussed with KPMG LLP its independence. The Audit Committee further considered whether the provision by KPMG LLP of the non-audit services described below is compatible with maintaining the independent registered public accounting firm’s independence.

Based upon the Audit Committee’s discussion with management and the independent registered public accounting firm and the Audit Committee’s review of the representation of management and the disclosures by the independent registered public accounting firm to the Audit Committee, the Audit Committee ratifiedrecommended to the inclusionCompany’s Board of Directors that the Company’s audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2014,2017, for filing with the Securities and Exchange Commission.

Respectfully submitted, |

Michael P. Cullinane, Chairman |

John N. Fox, Jr. |

Art Gilliland |

Jean K. Holley |

Matthew Moog |

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FEES AND OTHER MATTERS

The Audit Committee has implemented policies and procedures for the pre-approval of all audit, audit-related, tax and permitted non-audit services rendered by KPMG LLP, VASCO’s independent registered public accounting firm. Those policies and procedures include a review of the independent registered public accounting firm’s audit plan and fee schedule for the period under review. If such audit plan and fee schedule are approved by the Audit Committee, the independent registered public accounting firm provides an engagement letter in advance of the start of the audit work to the Audit Committee outlining the scope of the audit and related audit fees. Our senior management will also recommend, from time to time, to the Audit Committee that it approve non-audit services that would be provided by the independent registered public accounting firm. Our senior management and the independent registered public accounting firm will each confirm to the Audit Committee that each non-audit service is permissible under all applicable legal requirements. A budget, estimating the cost of the non-audit services, will be provided to the Audit Committee along with the request. The Audit Committee must approve both permissible non-audit services and the budget for such services. The Audit Committee will be informed routinely as to the non-audit services actually provided by the independent registered public accounting firm pursuant to this pre-approval process. The Audit Committee has also delegated to its Chairman the authority to pre-approve KPMG permissible non-audit services, with the Chairman and KPMG required to summarize any such approvals at the subsequent Audit Committee meeting.

The following sets forth the amount of fees paid to our independent registered public accounting firm, KPMG LLP, for services rendered in 20142017 and 2013:2016:

Audit Fees:The aggregate fees billed by KPMG LLP for professional services rendered for the audit of the Company’s annual consolidated financial statements, the reviews of the consolidated financial statements included in the Company’s quarterly reports on Form 10-Q, and services normally provided by the independent registered public accounting firm in connection with statutory and regulatory filings were $939,342$1,744,762 for the fiscal year ended 20142017 and $855,000$1,495,914 for the fiscal year ended 2013.2016.

Audit-Related Fees: In 2014 and 2013, there were no fees billed by KPMG LLP for audit-related services.

Tax Fees:The aggregate fees billed by KPMG LLP for tax compliance and tax advice were $12,600$76,826 in 20142017 and $21,400$9,334 in 2013.2016. The 20142017 fees represent permissible foreign subsidiary tax compliance services and 2013permissible tax consulting services in the U.S. The 2016 fees relate to permissible foreign subsidiary tax returns.compliance services.

All Other Fees: NoThere were $68,507 of other fees were billed by KPMG LLP for 2014in 2017 and 2013.$52,254 in 2016, associated with the performance of permissible attestation services.

It is currently the policy of the Audit Committee to pre-approve all services rendered by KPMG LLP. The Committee is authorized by its Charter to review and pre-approve the audit plan and all other audit and permitted non-audit services, and related fees or other compensation to be paid to KPMG LLP. The Audit Committee pre-approved all of the above fees for both 20142017 and 2013.

COMPENSATION COMMITTEE REPORT

The Compensation Committee has reviewed and discussed with management the section of this Proxy Statement entitled “Compensation Discussion and Analysis,” and, based on such review and discussions, recommended to our Board of Directors that the “Compensation Discussion and Analysis” section be included in this Proxy Statement. The Board approved our recommendation.

Respectfully submitted,

John N. Fox, Jr., Chairman

Michael P. Cullinane

Art Gilliland

Jean K. Holley

Matthew Moog

COMPENSATION DISCUSSION AND ANALYSIS (CD&A)

This CD&A describes the material components of compensation and discusses the compensation decisions for our named executive officers listed in the Summary Compensation Table below. The NEOs are as follows:

Introduction· President and Chief Executive Officer — Scott M. Clements (CEO);

·Executive SummaryVice President and Chief Financial Officer — Mark S. Hoyt (CFO); and

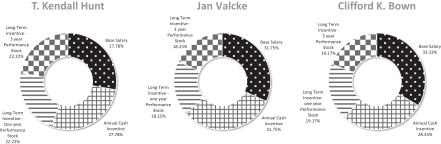

· Chairman and former Chief Executive Officer — T. Kendall Hunt (former CEO or Chairman).

Mr. Clements became a named executive officer in November 2016 when he was appointed President and Chief Operating Officer. In July 2017, Mr. Clements succeeded Mr. Hunt as CEO. Because Mr. Hunt was a named executive officer from January to July of 2017, he is included in this section as a named executive officer.

2017 SAY-ON-PAY AND SAY-ON-PAY FREQUENCY VOTES

At our 2017 annual meeting, 96% of the votes cast by our stockholders approved our Say-on-Pay proposal. We meet with key investors throughout the year to understand the topics that matter most to them, including any that relate to executive compensation. We consider any such stockholder input, and evolving practices in the market, to strive for alignment in our executive pay programs.

Consistent with the recommendation of the Board, at our 2017 annual meeting, 53% of the votes cast by our stockholders approved our proposal to hold Say-on-Pay votes every three years. Therefore, at this time we will continue to hold such vote every three years.

EXECUTIVE SUMMARY

Our Company Strategy

We engaged in a detailed corporate strategic planning process in 2016 and developed a process for updating our strategic plan at least annually. In 2017, we delivered on executing that plan. Our senior management team was responsible for numerous goals in 2017, including:

1. Return to growth after a 20% decline in revenue in 2016 while maintaining positive cash flow

2. Grow software and services revenue while sustaining our profitable hardware business

3. Execute on our Trusted Identity technology strategy

4. Effectively execute our succession planning following the retirement over the last several years of our top three executives who had been with the company for many years

5. Fill out a strong management team able to execute on our strategic plan in the years to come

6. Build new capabilities in sales, marketing, product management, and software development

7. Strengthen our internal business processes and systems

8. Expand our investor outreach

9. Exit non-core businesses; restructure where needed

10. Establish and execute an active and disciplined M&A/strategic partner plan focused on strategically aligned and economically attractive businesses

A number of these goals reflect a fundamental evolution of the Company that is underway. We are experiencing a transition in leadership, in geographies that we serve, in revenue source as growth in our hardware market dissipates, and in the technology needs of our customers. We have many strengths that are helping us navigate this evolution including strong leadership, strong customer relationships, compelling new product announcements that address urgent business needs, a growing market for our overall solutions, a sound strategy, a healthy business that has delivered positive results for more than a decade and a strong balance sheet.

Our 2017 Performance

Company Financial Results

·VASCO’s revenue from continuing operations for 20142017 increased by 30%1% to $201.5$193.3 million from $155.0$192.3 million in 2013, and 1%2016, after a 20% decline from 2015 to 2016

· Gross profit was 70% revenue for 2017, in 2013 over 2012. Over a two-year periodan increase from 2012 through 2014, revenue increased by approximately 31%.

The relative comparisons68% of revenue in each year, 20142016

· The Company continued to 2013be cash flow positive and 2013brought its cash balance to 2012, reflect the transactional nature of our business where the absolute amount$158.4 million at December 31, 2017, with no debt

· The Company increased its revenue from non-hardware software and services by 29% in 2017 to 46% of revenue, reported in any given period is a reflection of the transactions closed in that period. Specifically with regards to the comparisonup from 36% of revenue in 2014 to 2013, the increase in revenues reflected an increase in hardware products sold to banking market customers and non-hardware products sold to both our banking market and enterprise security market customers. Revenues from the banking market accounted2016

Our results for 83% and 82% of our revenues in 2014 and 2013, respectively. Our consolidated gross profit for 2014 increased 28% from 2013, and gross profit margin was 63.4% in 2014 compared to 64.4% in 2013.

Total compensation for each of our named executive officers increased in 2014 from 2013 because their compensation is largely incentive based and, for 2014, our results exceeded2017 met the performance targets established by the Compensation Committee at the beginning of 20142017 for annual cash incentive compensation and forbonuses. For long-term performance based equity incentive compensation, but didwhich was measured on a three-year performance period from 2015 — 2017, the performance targets were not meet such targets for 2013. The increases in total compensation in 2014 compared to 2013 as reflected in the Summary Compensation Table below, excluding All Other Annual Compensation (which includes expat payments for assignment to Switzerland for our Chief Executive Officer), was approximately 76% for our Chairman and Chief Executive Officer, 68% for our President and Chief Operating Officer and 72% for our Executive Vice President, Chief Financial Officer and Secretary.

Executive Compensation Practices

WHAT WE DO

|

|

|

|

|

WHAT WE DO NOT DO

|

|

Consistent with our Compensation Program and Philosophy described below, the Compensation Committee designed 2014 total compensation potential formet. As a result, our named executive officers did receive a cash bonus for 2017 but did not earn their three-year performance based largelyequity issued in 2015. The long-term performance based equity compensation issued at the beginning of 2017 will be measured on incentive compensation.three-year performance from 2017-2019. The “Summary Compensation is designed to create incentives for strong operational performance and forTable” below reflects the long-term growth and value of the Company, thereby closely aligning the interests of management with the interests of our shareholders.

14

Approximately 69% oftotal compensation earned by our named executive officers’ targetofficers for 2017.

Company Strategic Results

While the first two goals above under “Our Company Strategy” may be measured quantitatively, the remaining eight goals are more qualitative in nature. And some are multi-year projects. In 2017, with respect to these eight goals, we either successfully achieved them or made substantial progress toward achieving multi-year goals. While the Compensation Committee chose to focus on quantitative goals for setting long-term compensation and annual bonus targets in 2017, performance against these qualitative goals was at risk in the form of performance-based cash bonusalso considered generally and equity awards. Performance targets for the 2014 annual cash bonus were based on VASCO’s annual budget and performance targets for the equity incentives were based on one-year and three-year revenue targets. Failurewith respect to meet the targets would result in reduced or no payment of cash bonus or issuance of shares. Overachievement of targets would result in the payment of cash or issuance of stock above the targeted amounts, subject to maximums.setting 2018 compensation amounts.

Base salaries for named executive officers remained unchanged in 2014 from base salaries paid in 2013.

Summary 2017 Compensation Results

The annual cash bonus opportunity for the named executive officers for 2017 was based 75% on the achievement of a one-year revenue growth target and 25% on achievement of a target for annual operating income excluding amortization. The calculations of revenue and operating income for these purposes excluded revenue from acquisitions completed during 2014. The annual revenue and operating income targets were based on VASCO’s annual operating budget and performance at the target level was expected when the targets were set.financial targets. As discussed more fully below, VASCO’s results in 20142017 exceeded the cash bonus targets.

targets and the named executive officers received cash bonuses in 2018 at 118.6% of target. The long-term equity incentive awards for 2014 were all performance-based awards and2017 were based 50%60% on the achievement of a one-year revenue target,three-year financial targets, and 50% on the achievement of a revenue target for the year ending December 31, 2016. Following achievement of the one-year revenue performance target, the earned restricted performance shares would be further subject to time-based vesting at the rate of an additional 25% per year for three years. The revenue target used for the one-year performance shares was the same as the revenue target used for annual cash incentive compensation in 2014. The three-year performance target was set using a compound annual growth rate in revenue over the performance period.40% time based vesting. If the three-year target is achieved, the performance shares will vest immediately. As discussed below, VASCO exceededimmediately after the one-yearclose of 2019. Time based shares vest semi-annually over four years. The three-year performance share target,based stock awards granted in 2015 for 2015-2017 performance were not earned and were forfeited as of the three-year measurement period will not be completed until the endclose of 2016.2017.

COMPENSATION OVERVIEW OF COMPENSATION PROGRAM AND PHILOSOPHYAPPROACH

The following Compensation Discussion and Analysis describes the material components of compensation for our named executive officers who are the individuals who serve as our Chairman and Chief Executive Officer; President and Chief Operating Officer; and Executive Vice President, Chief Financial Officer and Secretary.

We operate in the very competitive informationglobal technology industry, specializing in internet securitycybersecurity, fraud management, e-signature and services,related hardware and software solutions, which are growing fastsubject to constant change and demand constantrequire market-leading innovation and market-leading innovation.management. To succeed in this environment, VASCO is required to attract, motivate, reward and retain highly talented and experienced executives and key employees.

Accordingly, the Compensation Committee is guided by the following principles:

·Compensation should be based on the level of job responsibility, individual performance and Company performance. The greater the level of responsibility, the greater the proportion of compensation that should be linked to Company performance and stockholder returns, because of a greater ability to affect Company results.

·Compensation should be aligned with the value of the job in the marketplace and should be designed to allow VASCO to attract, motivate and retain the caliber of executive talent that we require to succeed in our industry.

·Compensation should reward performance, both annual and long-term. Accordingly, the Compensation Committee believes that a substantial portion of an executive officer’s compensation should be subject to achieving measurable performance criteria that are linked directly to the Company’s strategy and to stockholder value, and that a substantial portion of that performance-based compensation should be paid in the form of equity.

15

·Exceptional performance, both for the individual and for VASCO, should be rewarded with a high level of performance-based compensation; likewise, when performance fails to meet expectations or lags benchmarks set by the Compensation Committee, the result should be compensation at a lower level.

·Performance-based compensation should be based on measures that are simple to understand and that are directly tied to the Company’s long-term strategies and operational goals.

·The objectives of pay-for-performance must be balanced with retention of key employees whose knowledge and experience are important to our long-term strategies and success. Even in periods of temporary downturns in Company performance or during periods of transition, the level of compensation should ensure that our executives willwould remain motivated and committed to VASCO and the execution of our long-term strategies.

We use compensation data for a peer group of companies as a reasonableness standard in determining the types and amounts of compensation we believe are appropriate for our named executive officers. We do not target a percentile range within the peer group. The base salary of our CEO, COO and Executive Vice President-CFO, respectively, were modestly below the median, in the top quartile, and in the top quartile. The total targeted compensation of our CEO, COOformer CEO and Executive Vice President-CFO,CFO, respectively, were in the bottomsecond quartile, modestly above the median,third quartile, and modestly above the bottom quartile. Thethird quartile for 2017. Upon his promotion to CEO in July 2017, Mr. Clements’ annual base salary was increased by $50,000 to reflect his new role. Mr. Clements’ total targeted compensation of our President and COO is established initially based upon U.S. compensation data, which is denominated in U.S. dollars, and then is converted on a one-for-one basis into Euros based on the Committee’s belief that the purchasing power of U.S. dollars and Euros are comparable in their respective domestic markets. Utilizing his dollar equivalent compensation, after conversion from Euros, his base and total compensation would beat July 2017 remained in the topsecond quartile and between the 50th and 75th percentiles, respectively.for CEO’s for 2017.

We believe that our approach to setting targets with multiple performance measurement metrics assists in mitigating excessive risk-taking that could harm VASCO’s value or reward poor judgment by our executives. We have allocated compensation among base salary and short and long-term compensation opportunities in such a way as to not encourage excessive risk taking, but to reward meeting strategic company goals that should enhance shareholder value over time. In addition, we believe that the mix of equity awards granted under our long-term incentive program, which includes awards with multi-year vesting, as well as the significant equity holdings of our named executive officers, also mitigates against risk that would not be justified by a longer-term investment horizon.

We do not consider the value of past awards when determining current compensation. Rather, our responsibility in setting compensation is to ensure that the expected values of the equity grants at the time they are receivedmade are reasonable.reasonable and competitive.

WHAT WE DO

·Reward performance, both annual and long-term, through incentive compensation.

·Balance between short-term and long-term compensation to discourage short-term risk taking at the expense of long-term results.

·Utilize performance-based equity to align the long-term interests with those of our shareholders.

·Have significant stock holdings by named executive officers.

·Clawbacks under plans and grant agreements.

·Multi-year vesting of equity awards.

WHAT WE DO NOT DO

·No excessive perquisites for our named executive officers.

·No special executive retirement programs that are specific to our named executive officers.

·No hedging transactions or short sales allowed.

The Compensation Committee’s Processes and Practices

The Compensation Committee of our Board of Directors makes all determinations regarding the compensation of VASCO’s named executive officers including the evaluation and approval of compensation plans, policies and programs offered to our named executed officers. The Compensation Committee operates under a written charter adopted by our Board of Directors and is comprised entirely of independent, non-employee directors as determined in accordance with various NASDAQ, SEC and Internal Revenue Code rules. The Compensation Committee has the authority to engage its own independent advisor to assist in carrying out its responsibilities under its charter.

The Compensation Committee designed 2017 total compensation potential for our named executive officers based largely on at-risk incentive compensation. Compensation is designed to create incentives for strong operational performance and for the long-term growth and value of the Company, thereby closely aligning the interests of management with the interests of our shareholders.

16The majority of our named executive officers’ target compensation was at risk in the form of a performance-based cash bonus and three-year performance based equity awards. Performance targets for the 2017 annual cash bonus were based on VASCO’s annual budget and performance targets for the equity incentives were based on three-year financial targets. Failure to meet the targets would result in reduced or no payment of a cash bonus or the issuance of shares. Overachievement of targets would result in the payment of cash or the issuance of stock above the targeted amounts, subject to maximums.

Consideration of Company and Industry Performance

The Compensation Committee took into account the Company’s performance during 2013,2017, its 20142017 budget, and five-year planlong-term strategy as well as an analysis of its peer group in its compensation decisions, as described below:

·Assessment of VASCO’s Performance. In 2017, we provided incentive compensation that would compensate the named executive officers for overall growth in VASCO’s business. We provided annual performance-based incentive cash compensation measured against the growth of our overall business in all sectors. Our annual cash bonus targets were based on total revenue, non-hardware revenue and EBITDA. For the named executive officers’ performance-based equity compensation, we used a three-year revenue performance target that will be measured at December 31, 2019, split equally between hardware and non-hardware revenue targets. Of the total equity award component, 60% is based on the three-year targets and the remaining 40% was granted as time based restricted stock vesting over four years. |

·Annual Performance Goals and Annual Assessments of Individual Performance. During February of each year, each of the named executive officers proposes for consideration by the Compensation Committee, annual goals (both individual and Company objectives) to be accomplished in the year. These goals are aligned with key Company strategic initiatives for the year. The proposed goals of each named executive officer, other than our CEO, are reviewed and discussed by the individual and our CEO before they are presented to the Compensation Committee. The Compensation Committee may solicit input from our named executive officers regarding goal setting and their performance if it believes such input to be appropriate and helpful to its review and decisions. The Compensation Committee often seeks further input from our CEO in establishing the annual performance goals for the other named executive officers. The proposed annual goals are reviewed, adjusted as the Compensation Committee considers appropriate and approved by the Compensation Committee. Progress is reviewed during the “performance year,” including a year-end performance review. The conclusions that result from the year-end review are used as one of the factors considered in determining an executive’s base salary for the following year. |

·Peer Analysis. In making compensation decisions, the Compensation Committee reviews targeted total compensation for our named executive officers against the total compensation paid by a peer group of publicly traded technology companies. This peer group, which is reviewed and updated by the Compensation Committee annually, consists of companies against whom VASCO competes for customers, talent and stockholder investment. The companies that were included in this peer group for purposes of determining 2017 compensation were determined by the Compensation Committee. The Compensation Committee has also consulted with Meridian Compensation Partners, LLC (“Meridian”) regarding the peer group in the past, with consideration given to matters such as the relative size and stage of our development compared to others with whom we compete and the availability of compensation information for potential peer companies. |

The peer group may change from year to year because compensation information at a potential peer company becomes available or unavailable (for example, information previously not available would become available once a company begins public filings, or information previously available could become unavailable if a company has been acquired and is no longer required to report such information publicly), because of a change in size of a potential peer company such that the Compensation Committee no longer considers it appropriate to consider the other company as a peer, or for other reasons determined appropriate by the Compensation Committee in its subjective judgment as it reviews potential peer companies. The Compensation Committee gathered information regarding the salary levels, bonus amounts, targeted bonus amounts and long-term equity award levels and types for executives at the peer group companies in positions comparable to those of the Company’s named executive officers. The data gathered was derived from information made publicly available in 2013

17

2016 regarding compensation paid by the peer group companies in 2012 (20132015 (2016 compensation data was utilized to the extent available at the time the Committee’s information was gathered in November 2013)late 2016).

There were 1218 companies in the peer group reviewed by the Compensation Committee as part of establishing 20142017 compensation levels for the named executive officers:

American Software, Inc. | Aspen Technology, Inc. | Bottomline Technologies, Inc. | Broadsoft, Inc. | Callidus Software, Inc. | Ellie Mae, Inc. | ||||||

|

|

Guidance Software, Inc. |

|

| Monotype Imaging Holding, Inc. | Progress Software, Inc. | PROS Holdings, Inc. | ||||

QAD Inc. |

|

|

| Seachange International Inc. |

|

|

|

|

Although the Compensation Committee reviews the compensation practices of the companies in the peer group, the Compensation Committee does not adhere to strict formulas or survey data to determine the mix or absolute value of compensation components. Instead, the Compensation Committee considers various factors in exercising its discretion to determine compensation, including the experience, responsibilities and performance of each named executive officer as well as the Company’s overall financial and competitive performance. The Compensation Committee believes that this flexibility is particularly important in designing compensation arrangements to attract and retain executives in a highly competitive and rapidly changing market.

Compensation Committee Processes and PracticesMeetings.

|

In addition, the Compensation Committee usesChairman in consultation with the following which it believes support good practices:other Compensation Committee members and the Secretary.

Independent Committee Members. All the members of the Compensation Committee are outside directors and are independent.

Role of the Independent Consultant.The Compensation Committee regularly retains an independent consulting firm from time to time as the Committee believes it is warranted. The Compensation Committee’s Charter requires the Committee to assess various independence factors to better understand the level of independence of the consulting firm. It retained Meridian,The Compensation Committee did not engage an independent global human resourcesoutside consulting firm as its independent compensation consultantwith respect to assist the Compensation Committee in evaluating executive compensation programs and in setting compensation for our named executive officers for 2014. Pursuant to Meridian’ retention arrangement, Meridian:2017 compensation.

Provided information regarding potential peer companies for consideration by the Compensation Committee in establishing the peer company groups used in setting compensation levels for 2014; and

Provided information regarding compensation practices for senior management positions at the companies determined by the Compensation Committee to comprise the peer company group.

The use of thean independent consultant provides additional assurance that VASCO’s executive compensation is reasonable and consistent with our objectives and the Compensation Committee’s guiding principles. At the end of 2017, the Compensation Committee re-engaged Meridian with respect to 2018 compensation. The consultant reports directly to the Compensation Committee and does not provide any services to management.

|